Doing Business in Georgia has been one of the favorite choices for investors from all over the world recently. The country of Georgia is an emerging country in the east of Europe, Georgia is a post-soviet country and it has been developing gradually since the rose revolution in 2003. Georgia is a neighbor country to Russia, Armenia, Turkey, and Azerbaijan. Georgia’s location between Asia and Europe has been helping this amazing country to develop and to move from the Soviet regime to become a unique success.

The ease of doing business in Georgia

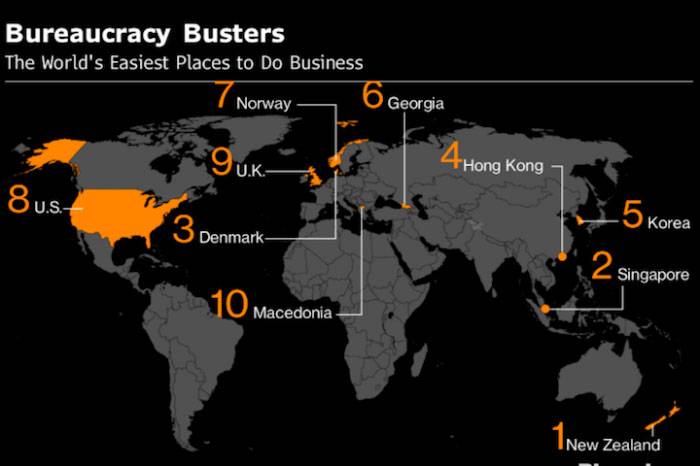

It is very easy to start a business in Georgia, It does not take more than 24 hours to register your company and no more than 15 minutes to open your business bank account. This is why Georgia ranked 7th in the World for Ease of Doing Business as the world bank announced in October 2019.

Georgia’ is rich with different resources, Fertile soil, rivers, and huge national parks which make the investment in the agriculture sector successful. in addition, The Georgian government has an ambitious plan for the development of this sector.

Starting a business in Georgia step by step

When I came to Tbilisi in 2016 for the first time as a tourist I was impressed by the ease of doing business and the transparency level in the government institutions. needless to say how beautiful is nature around here. it was like falling in love at first sight.

YOUR first move should be visiting one of the Public Service Halls in the main cities in Georgia to get a copy of the company’s official charter. If you planed your business in the capital city of Georgia – Tbilisi – this is the location of the Public Service Hall in Tbilisi.

The company charter should be filled in Georgian and English languages, I advise you to find a lawyer or an experienced person to do that for you. My team and I can help you to finish all of the legal procedures and we can help you to plan your business in Georgia successfully. Contact us now

You need to get a legal address for your business before filling the charter, getting the address is necessary for the registration process and you can change the address or any of the corporation details later at any time.

After getting the above-mentioned steps done you need to submit your company charter in The National Public Registry of Georgia, You should have your passport with you. The fee of the registration is 131 GEL for the normal service which requires 24 hours to get your company registered, you will receive an English version of the corporate file.

The second day you will receive a message from SDA informing you that your company is registered and you will receive the business license extract, Now you may go to one of the banks in Georgia to open your business bank account, in my case I’m one of TBC bank loyal customers.

The final step is to register your company in the revenue service of Georgia – the governmental organization that is responsible for calculating your tax – definitely you need a professional accountant for these services.

You can choose one of the many insurance companies in case you want to benefit from their service.

If you are wondering about forming a company remotely in Georgia click the image below.

The types of legal entities in Georgia

The most popular form for investors is LLC which stands for Limited Liability Company. Needless to say, there are many different forms and legal structures, LTD is a different type of legal entity. LTD is an abbreviation for “limited company.” A limited company is a type of businesses structure that limits the personal liability of the shareholders, LLC & LTD corporations are the best for partnership. Individual Entrepreneur is another form which is the favorite type for solo entrepreneurs from around the world.

If you have a foreign company you can establish a subsidiary in Georgia easily. the main foreign company will be the owner of the local subsidiary. However, the subsidiary will operate independently.

How to open LLC in Georgia (step by step) 2022 Amendments

Limited liability Company (LLC) is one of the most common forms of entrepreneurial society in the world, especially in Georgia. The origin of it was based on two reasons. First, the procedure for its creation is much easier than that of a joint-stock company (Now in Georgia based on law, the minimum amount of the subscribed capital of a joint-stock company at the moment of registration of the joint-stock company shall be GEL 100 000) ; and secondly, partners have limited their liability to the creditors of the society. Only society is liable for obligations with third parties. Mainly, this – the second reason is the basis for the creation of a limited liability company because the founders prefer to avoid liability with their personal property.

Now, the question arises : How to establish a LLC in Georgia?

We will provide you with this information!

To start a business it is necessary to register (establish) company in Business Registry of Georgia (Register of Entrepreneurs and Non-Entrepreneurial Legal Entities). Based on the current Law on Entrepreneurs, mandatory documents are required for registration of an entrepreneurial company.

Registration and necessary documentation to submit at Business Registry

- Partner’s General Agreement/ Founding Agreement (with information)

Partner’s General Agreement is based on the following approach: the statute should be a kind of constitution of an entrepreneurial society, the need for change of which is seldom must stand. In this document following information needs to be indicated and is a must: Business Entity Legal form, Business Entity Official Name, Legal Address, Number of shares placed, Partners and shareholders’ participation in equity, Member/members of the governing body, The scope of representative authority of the members of the governing body, The person responsible for the management and representation of the entity’s authorized user’s e-mail address and his/her mobile phone number and e-mail address of the mobile operator operating in Georgia in his/her possession/use, E-mail address of the person responsible for the management and e-mail of the subject’s authorized user’s e-mail address, Georgian Phone Number.

- The company charter

Another mandatory document for establishing business is a Company Charter. At the beginning of 2022, numerous amendments were adopted to the Law of Georgia on Entrepreneurs, which is aimed to improve business and bring market closer to European regulations. However, some of them made business/company registration harder than it was before. Before changes, while requesting company registration in House of Justice (Business Registry), the draft of charter was available in both Georgian and English, it was easy to fill out with information and requirements. According to the law, by the order N791 of the Minister of Justice of Georgia of November 29, 2021, the standard charters (non-individualized text) of entrepreneurial societies were approved, which can be used according to the desire of the enterprise.

There is standard charter draft, for different forms of societies approved by the Minister of Justice, which can be found on official web page; However, all of them are in Georgian and if someone who does not know our language will need help of professional to understand the rules and information in it.

Likewise, it is not only concern. Based on the new regulations, charter is main document regulating the ruling process of the company. It establishes content of the charter for entrepreneurial community as part of the founding agreement and it includes data: legal form of company, subject of activity, shares, restrictions on property rights, ruling regulations, scope of the partners’ decision, the right to appoint/dismiss the director, the rights of the director, the scope of the director’s decisions, liquidation and etc. Without fully understanding how to rule, control and manage a company, creating charter is laborious. This standard charters can be used normally but if you want to have the main document fitted specially on your company, you will need lawyer’s assistance in making new charter.

- Company Legal Address

One of the most important requirements to establish LLC in Georgia is Legal Address. To obtain a legal address for LLC registration purposes you have several possibilities:

- A) Notarized Consent of Registered owner of a Real Estate Property. This consent should contain information about details of property and LLC. However, notarized property is not requested when owner express his/her wish in front of the Public Service Hall employee. So, you can go with someone who gives you a legal address and everything will be done at the place.

- B) You should have your property in Georgia and express you wish to use it as LLC Legal Address.

- C) You can have a lease agreement based on which legal address can be identified.

- d) You can use virtual address offers from organizations in Georgia.

There are several biggest co-working organizations in Tbilisi, with many locations around the city. Their well-placed locations provide great accessibility, so that no matter where you live in Tbilisi, there will be a working space somewhere near you. The companies also offer the ability to register your virtual office at any of their locations.

They offer a wide range of services for businesses and entrepreneurs, such as:

Conference rooms: rooms of varying capacity and layout including classroom, U Shaped, and theatre. (Prices for these depend on the capacity, layout, and length of use.)

Meeting rooms: 1 hour = 40 GEL, half-day = 300 GEL, and full-day = 500 GEL.

- Please, mote that now these prices are approximate, and they can be changed day by day.

All the workspace areas are comfortable and well lit.

- Additional document – Notarized passport

Before the new changes and now there is an additional indispensability to present the passport of the founders (partners) and its notarized translation (if the passport is not in English or Russian).

- Fees and Payment

Prices for LLC Registration has changed since May, 2022 and now you can have your LLC Registration done with following durations and price:

Processing Time |

Price |

|---|---|

within one working day | 200 GEL |

In the same day | 400 GEL |

Additional Fees

- Confirmation of the signatures of the parties on the transaction submitted for registration – 7 GEL is added to the status fee;

- Preparation of extract in English language – 26 GEL (the mentioned fee is added to the fee, the preparation of extract in English language is requested together with the selected one);

The taxation system in Georgia

The standard added value tax VAT is 18%, but for SME – Small and Medium Enterprises – the vat is only applied if the company makes more than 100000 GEL profits in any 12 months. a corporate income tax for a company in Georgia is 15% it can reach 20% in some cases because of a 5% dividend tax. As a general rule, Georgia does not apply the excise tax, but certain products can be subjected to this tax. For more information contact the Nomad Entrepreneur team. More details about taxation in Georgia by clicking on the image below

Virtual Zone in Georgia

An opportunity for Information Technology services providers and anyone who works in this industry. You maybe get a tax free status If the company registered in the virtual zone of Georgia. The changes to the tax code made in 2010 and enacted from January 1, 2011. The law declared

For receiving virtual zone person status, the later must submit the statement at LEPL Financial-Analytical Service. The candidate fills a special form of application on the web site (www.fas.ge) of LEPL Financial-Analytical Service, which must be sent to LEPL Financial-Analytical Service. To learn more about Virtual Zone licenses and permits check our accounting service. Read more about virtual zone of Georgia

The cons of establishing a business in Georgia?

As simple it seems to start a business in Georgia but there are a lot of challenges and precautions you should consider before starting your business in Georgia.

Small market: Georgia is a small country and the population of Georgia is about 3.8 million.

Low purchasing power: As a result of the high unemployment rate, The purchasing power is low.

The high competition level in some industries: Georgia is a neighbor to Russia and Turkey that has made the competition with Russian and Turkish products is very high especially in the food industry, not to mention the Ukrainian and even Iranian products.

The pros of starting a business in Georgia?

When investing in Georgia, you can enjoy the following benefits:

- Free industrial zone, No corporate tax, no income tax or profit tax 0% Property Tax Reduction of VAT rates. if a commercial entity operates outside the FIZ or transacts with other entities. the market price of goods supplied to persons registered under Georgian law will be charged at 4%.

- Special Commercial Company Can sell and re-export foreign goods Exemption from tax on profits from sales and re-export of foreign goods.

- International Finance Corporation (IFC) Operating outside Georgia Out of any Fiz Benefits derived from financial services are exempt from profit tax. The company is punished if revenues exceed 10% of total revenues.

- Customs Regime for Export Companies. All companies producing export products in Georgia can apply for a special permit from the internal processing customs system that allows the import of raw materials for the production of goods without paying customs duties or VAT. As a result, the region offers many benefits to foreign investors, encouraging them to establish a business in Georgia. If you are interested in registering a company in Georgia, our global business configuration can help you provide effective solutions, our consultants in Georgia will provide you with answers to your questions. Contact us today for more information.

What you should know before starting a business in Georgia?

The first step in establishing a business is to know what kind of business is happening, what kind of business you are doing well, and what kind of business is likely to flourish in the Georgian economy.

Whether it’s a small business idea or a complete investment plan, knowing what kind of business you want to build and its viability in the market will help your business survive in these crowded industries.

A functioning business structure

The business structure is essentially the constitution and identification of the legal status of the company. Therefore, this is an important step in clarifying the legal structure of your business, which represents the most appropriate model.

Determine the costs of starting your business

When investing in a trading company in Georgia, you need to calculate the associated costs to do this. the total value of the investment, as well as the capital, rent and other maintenance costs, as well as variable and fixed costs, are included.

Know the regulations in Georgia

Registration of all Georgian enterprises is carried out in accordance with the rules and regulations set out in the following provisions:

the civil code, 1997

the law on entrepreneurs, 1994

the law on assistance and guarantees for foreign investments

These rules of law stipulate the manner in which new businesses are set up in Georgia

If you are interested in setting up a business in Georgia, know that the country provides a welcoming, conducive and lively business environment with abundant business opportunities.

Nomad Entrepreneur is a consulting firm helping entrepreneurs and firms with company incorporation, accounting, and more services in Georgia. To know more, contact us – we would be happy to help- filing the application form in detail is essential.

In the end, we hope this full guide support you and make your mission of building your success abroad easier. we wish you many successful businesses in Georgia and a happy life among the Georgian people.

For more useful articles check our blog here

For free helpful videos online make sure to subscribe to our YouTube channel from this link

Read this if you are wondering about business opportunities in Georgia?