Owning business and ruling a company in Georgia is easier than in many European countries. In order to develop the economy and business in general, Georgia has less limited regulations that attract individuals to invest here, stipulating in increase of the local employment rate. Likewise, every business holder, while running a company, should consider some details. For example: there are regulations that may demands from you a physical location. In Georgia, food safety is a serious concern, so while having food industry, specific norms apply, including food preparation standards or liability laws in connection with your obligations to customers. Knowing taxation details undoubtedly helps you set appropriate prices and rule company without additional problems and headaches. Therefore, there are main things you need to consider:

Registration in the Register of Entrepreneurs and Non-Entrepreneurial

As we discussed in a previous article, this step is mandatory and, without proper registration in the Business Registry of the House of Justice of the Ministry of Justice, no one is allowed to have any kind of business. Meaning you cannot have any legal business without lawful registration. After company registration, which is not a complicated procedure, legal entity is officially established and official extract (which proves legal status) is done in both Georgian and English. Read more

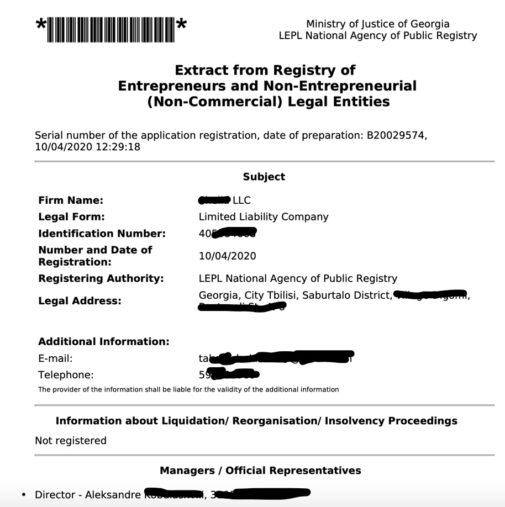

Hang your business extract document on a visible place

It is necessary to hang an extract from the register of entrepreneurs and legal entities at your workplace on a visible place. It is mandatory to have your extract visible in a working place while inspectors from Revenue Service (If they come to check you, which happens rarely) will request to present them. The aim is that not only the state representatives, but also every customer who comes to have your service should see and know which company they are addressing to. Public access to this particular information is important. Note, that not every information could be spread, it may cause in legal liabilities.

The address must match the registration address, otherwise change is necessary

Legal address is one additional requirement. We have spoken about that in previous article but one important thing needs to paid attention. Legal address is not mandatory for only registration, but for operating on market as well. Main principle for it to obtain is that address is required for getting correspondence. May be there is some letters send, court case against you, revenue service official documents to receive and it is impossible without your legal address. You should take care in case of changing the office and the address it must be changed in House of Justice as well. Every information extract from Entrepreneurs and Non-Entrepreneurial Registry contains must be updated. Of course, there are additional services as virtual addressing. However, you should be noted that in order to avoid any problems, it is better for the company to update the official data with the address at which it officially carries out its activities.

Taxation – FOR LEASE

Taxation in every business field and in every country is indispensable factor of existing. In Georgia, if company has its own real estate and property and does not have to rent a place, does not pay any taxation, but in case of having a lease agreement (which is similar as rent but with aim to get profit from work) every 20% of contract fee must be paid in Revenue Service of Georgia. Contract parties themselves decide which one pays it, but most probably, the company is the one that pays tax to Revenue Service.

Income tax is 20% per employee, Additional pension TAXATION is 2%

In Georgia, additional duty is to pay 20% of salary of each employee to Revenue Service and 2% additional fee as pension taxation. These taxes are mandatory for all legal entities that have a hired employee and avoidance of it incurs appropriate administrative and tax liability. Accordingly, a person who wants the company to be fully operational and be in compliance with the law must complete the registration of employees and pay all of taxes.

Accounting in Georgia

Most important part of company financing is accounting service, which needs to be provided by qualified person. Except from regular work, they do that are preparing accounts and tax returns, monitoring spending and budgets, auditing and analysing financial performances, financial forecasting and risk analysi, advising on how to reduce costs and increase profit, compiling and presenting financial and budget reports, in Georgia, there are declarations, which company needs to upload in Revenue Service official portal. There are several types of declarations and different deadlines are set for uploading them on the portal and only a individul with appropriate education can do it.

At the same time, in order to properly manage your company and guarantee peace of mind, it is necessary to take into account the types of inspections that are provided by the Georgian legislation. The company management should take into account two types of state CHECK: Audit and Revenue.

The main task of the audit is to identify errors and eliminate ways to find them. Unlike some audits, which by law are always mandatory, audits can also be conducted voluntarily to improve performance. The audit procedure is mandatory in the following cases:

1. Credit and insurance associations, joint stock groups, state and municipal unitary enterprises, securities market participants are obliged to pass the audit procedure. Annually;

2. Companies with an annual income of more than 500,000 GEL;

3. Company assets at the end of the year exceed the minimum salaries by 200,000 times;

4. The assets and profit of the LLC exceeded the norm established by the charter of the company.

If you do not find yourself in this list, it is better for you, you can be calm.

What is important about Revenue Service checking is that face-to-face inspection of the tax inspection is carried out after prior notice to the taxpayer. To do this, a letter is usually sent to the company’s location (legal) address. Almost all firms are afraid of this event because inspectors almost always detect significant irregularities that lead to fine of the company. The inspection process consists of several stages, as taxpayers are selected to be visited by inspectors. Each stage requires the implementation of certain complex actions. At the end of the study, specialists will make a decision based on the information received. It will conclude in fine or a positive result.

Would you like to read more about business in Georgia? What topics are you interested in more? Write us in the comments and we will prepare an article for you!